Planned Giving

Contact Us

Melanie Sastria

Phone: 530-753-2894x109

E-mail: finance@dccpres.org

Planned Giving

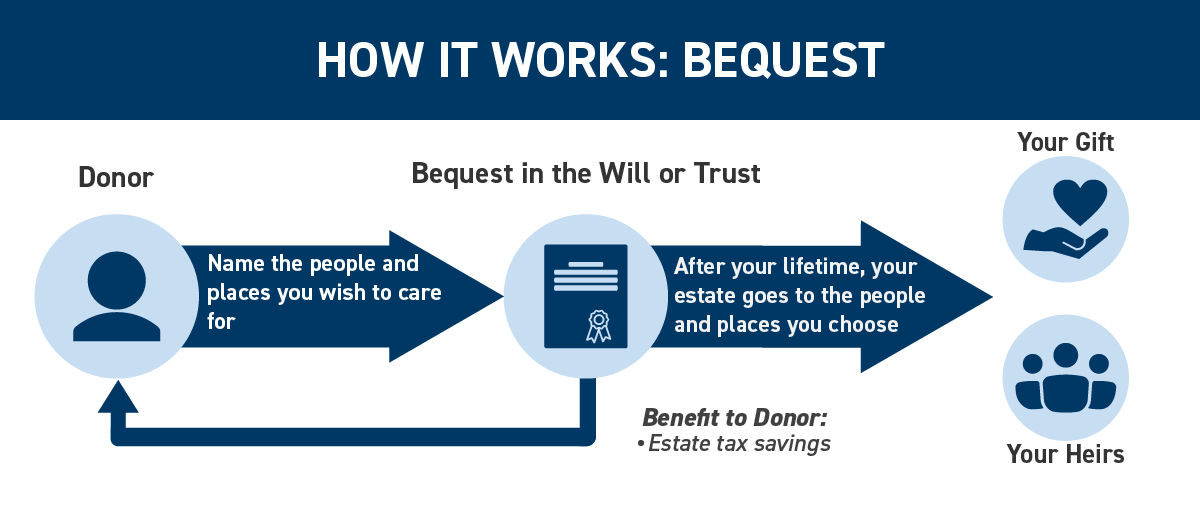

A will represents a person's final wishes and intentions. After providing for your loved ones, please consider one final act of generosity through a bequest in your will or living trust that provides enduring support for our vital work. For many of us, this will be the most significant gift we will make - our gift of a lifetime.

If you have not done so, you need to make a will or a living trust instrument. This is a significant and important undertaking. If you have a will or living trust, you may see your attorney to make an amendment.

Melanie Sastria

Phone: 530-753-2894x109

E-mail: finance@dccpres.org

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

Explore More Options